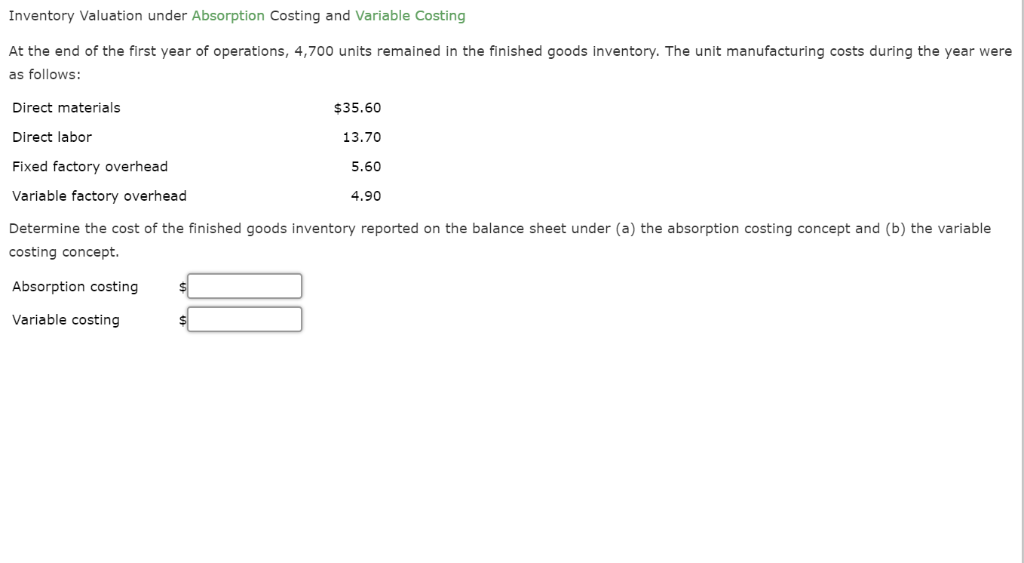

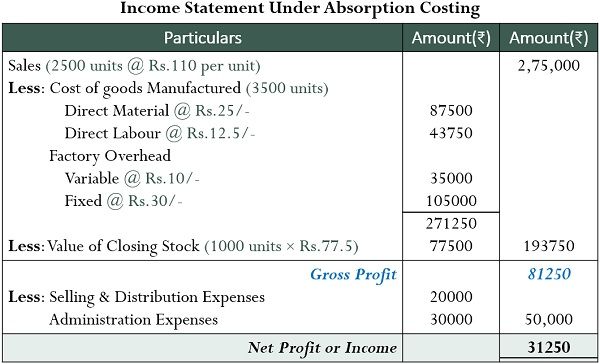

Under full absorption costing, variable overhead and fixed overhead are included, meaning it allocates fixed overhead costs to each unit of a good produced in the period–whether the product was sold or not. The treatment of fixed overhead costs is different than variable costing, which does not include manufacturing overhead in the cost of each unit produced. Absorption costing is a GAAP-compliant method of accounting for all manufacturing costs as product costs, including both variable costs and fixed overhead costs. This leads to an accurate representation of product cost on the income statement.

Most companies may have to transition to absorption costing at some point, however, and it can be important to factor this into short-term and long-term decision-making. Because absorption costing includes fixed overhead costs in the cost of its products, it is unfavorable compared with variable costing when management is making internal incremental pricing decisions. This is because variable costing will only include the extra costs of producing the next incremental unit of a product. Absorbed cost, also known as absorption cost, is a managerial accounting method that includes both the variable and fixed overhead costs of producing a particular product.

(d) With the help of absorption rate, manufacturing expenditures that aren’t related to a single product get distributed. This rate could be the factory’s overall recovery rate or departmental recovery rates. Production expenses, administrative costs, selling costs, and distribution costs are all divided into functional categories. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

To complete periodic assignments of absorption costs to produced goods, a company must assign manufacturing costs and calculate their usage. Most companies use cost pools to represent accounts that are always used. Generally accepted accounting principles only require absorption costing for external reporting, not internal reporting.

The distribution of the accumulated overhead cost of a production department amongst its cost units is known as overhead absorption. On the downside, things can get a little tricky when it comes to making an exact calculation of absorbed costs, and knowing how much of them to include. If all of the variables are not considered carefully (including depreciation, administrative expenses, and yearly fluctuations in your expenses), it can give you misleading results. Variable costing isn’t allowed for external reporting because it doesn’t follow the GAAP matching principle. It fails to recognize certain inventory costs in the same period in which revenue is generated by the expenses. Absorption costing provides a more true image of profitability for a company.

Ideally, the quantity and cost of materials in each product are uniform, and processing is also uniform. The overhead rate is applied to determine the amount of overhead to be charged to a job. All products, jobs, or services pass through one or more producing cost centers. should you and your spouse file taxes jointly or separately This means the company would allocate $10 of overhead to each unit produced. We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

By doing so, a case can be made to charge all overhead costs to expense as incurred. Most companies will use the absorption costing method if they have COGS and it may be required for external reporting purposes because it’s the only method that complies with GAAP. Companies may decide that absorption costing alone is more efficient to use. This characteristic of absorption costing can lead to differences in reported profits compared to variable costing, especially when there are changes in production levels and inventory levels. By allocating fixed costs to inventory, absorption costing provides a fuller assessment of profitability. This causes net income to fluctuate between periods under absorption costing.

Using the absorption costing method will increase COGS and thus decrease gross profit per unit produced so companies will have a higher breakeven price on production per unit. Public companies are required to use the absorption costing method in cost accounting management for their COGS. Many private companies also use this method because it’s GAAP-compliant and variable costing is not. Since COGS is higher under absorption costing, net income is lower compared to variable costing.

Understanding accurate unit costs is key for inventory valuation and pricing decisions. In addition, the use of absorption costing generates a situation in which simply manufacturing more items that go unsold by the end of the period will increase net income. Because fixed costs are spread across all units manufactured, the unit fixed cost will decrease as more items are produced. Therefore, as production increases, net income naturally rises, because the fixed-cost portion of the cost of goods sold will decrease.

The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods. It can make a big impact on the per-unit price if a company has high direct, fixed overhead costs. Companies that use variable costing may be able to allocate high monthly direct, fixed costs to operating expenses.